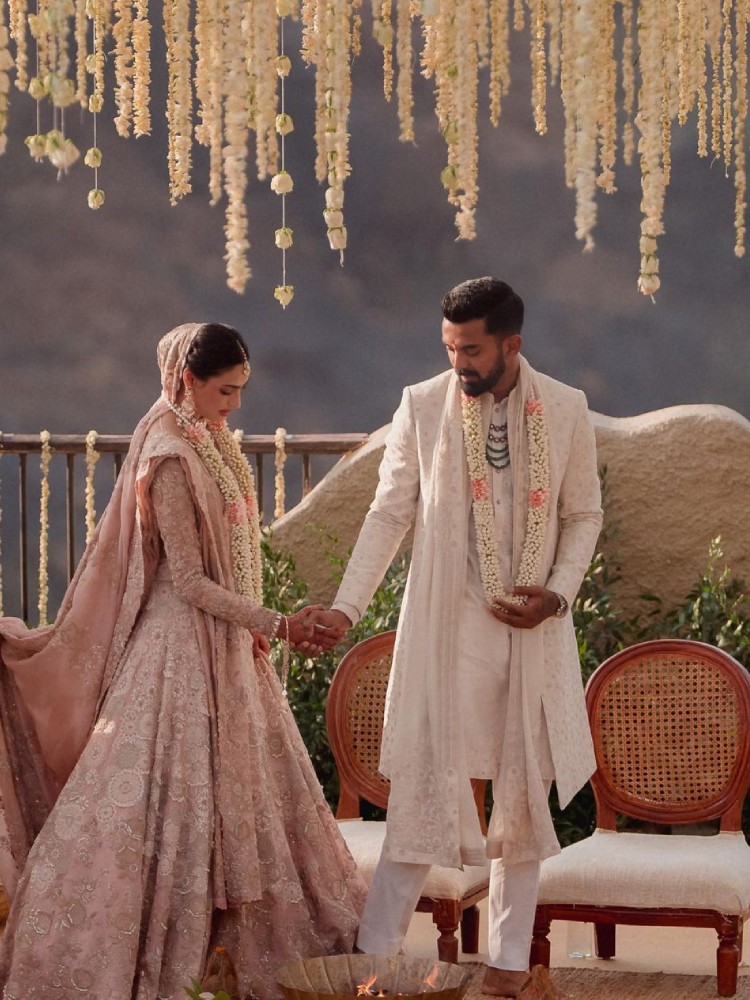

Movie celebrity Athiya Shetty married the cricketer KL Rahul previously this week which took place at her father Suniel Shetty’s farmhouse situated in Khandala. A close group of friends – which took into account the who’s who of the Bollywood industry and Indian cricket – took part in the cozy ceremony, with pictures that went viral on social media. Among a lot of wedding-associated discussions now taking place online, a lot of discussions are taking effect regarding the gifts received by the couple.

As per the reports, the two received many exquisite gifts from their friends and family – which took into account an apartment in Mumbai, luxury vehicles and jewellery.

According to the reports, Sunil Shetty presented the newlyweds with a flat costing ₹50 crores, on the other hand, his good friend Salman Khan gave a presentation to Athiya an exotic Audi car costing ₹1.64 crores. Celebrity Jackie Shroff gave a present to the bride a ₹30 lakh Chopard watch, on the other hand, Arjun Kapoor purchased her a diamond bracelet worth ₹1.5 crores.

Cricketers Virat Kohli and MS Dhoni also chose costly gifts, supposedly presenting Rahul a BMW car costing ₹2.17 crore and a Kawasaki Ninja bike costing ₹80 lakhs particularly. The question is are these gifts taxable? Although gifts in India are taxable if their total value during the year exceeds ₹50,000 as ‘income from other sources’, this goes to weddings. Income tax authorities have exempted those receiving gifts at weddings, subject to a few conditions.

Whatever gifts a newlywed couple receives from their immediate family (as well as friends) are exempted from the scope of taxation. The exemption does not apply to monetary gifts received on events such as birthdays, anniversaries, etc.

“Marriage of the individual is the only occasion when monetary gift received by him will not be charged to tax. Apart from marriage, there is no other occasion when monetary gift received by an individual is not charged to tax,” a guide on the Income Tax website explains.

Having regard to KL Rahul and Athiya Shetty’s marriage, it would imply that the gifts they got from family and friends for their marriage are also not taxable.